The Prime Minister Youth Business Loan (PMYBL) is a groundbreaking initiative launched by the Government of Pakistan to promote entrepreneurship among the country’s youth. Recognizing the potential of young people as key drivers of economic growth and innovation, the government designed this program to support aspiring entrepreneurs with financial resources, helping them turn their ideas into thriving businesses. As unemployment remains a major concern in Pakistan, the scheme plays a crucial role in promoting economic empowerment and creating jobs.

Objectives of the Program

The main objective of the Prime Minister Youth Business Loan is to provide financial assistance to young individuals who lack the necessary capital to start their own businesses. The program seeks to:

- Promote Entrepreneurship: Encourage self-employment and new business ventures, especially in underdeveloped areas.

- Reduce Unemployment: Create job opportunities by helping youth establish their own businesses.

- Foster Innovation: Support innovative and sustainable business ideas to diversify the economy.

- Boost Economic Growth: Inject more entrepreneurial ventures into the economy, contributing to overall GDP growth.

Eligibility Criteria

- Age Limit: The applicant must be between 21 to 45 years old. This age range ensures that both young graduates and experienced professionals can benefit from the program.

- Nationality: Only Pakistani citizens are eligible to apply for the loan.

- Educational Background: There is no formal educational requirement, but applicants must be literate enough to understand and run a business. However, individuals with a relevant educational background in their chosen business field may have an advantage.

- Business Sectors: The loan is available for a wide range of sectors, including agriculture, manufacturing, services, retail, and more. This diversity allows young people from different fields to benefit, whether they want to start a small shop or a tech startup.

Loan Features and Amount

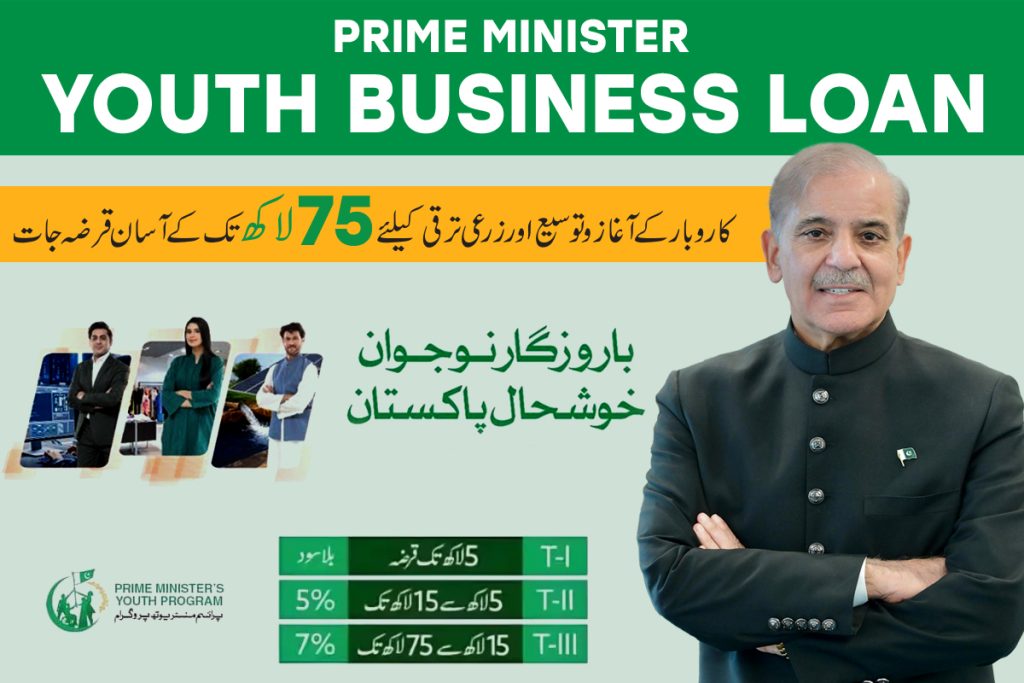

One of the most attractive features of the Prime Minister Youth Business Loan is the wide range of financial assistance it offers to suit various business needs. The loan amount is divided into tiers, allowing flexibility based on the scale and scope of the business:

- Tier 1 (T1): Loans ranging from Rs. 100,000 to Rs. 1 million, with a low markup rate, typically aimed at small businesses or startups.

- Tier 2 (T2): Loans between Rs. 1 million and Rs. 10 million, designed for medium-sized businesses.

- Tier 3 (T3): Loans up to Rs. 25 million, for larger business ventures.

The interest rate for these loans is subsidized, making it easier for young entrepreneurs to repay the amount without a heavy financial burden. Typically, Tier 1 loans have a lower markup rate compared to Tier 2 and 3.

The repayment tenure is another attractive aspect of the loan. Borrowers can repay the loan over a period of up to 8 years, with a grace period of up to 1 year, allowing businesses to establish themselves before they start repaying the loan.

Application Process

The application process for the Prime Minister Youth Business Loan is relatively simple, but certain documents and procedures must be followed:

- Documentation: Applicants must submit a business plan, a valid CNIC (Computerized National Identity Card), and in some cases, proof of relevant experience or qualifications in the business sector they are entering.

- Online Application: The government has made the application process easy through an online portal, allowing applicants to submit their forms electronically.

- Designated Banks: The program is managed through several participating banks, including the National Bank of Pakistan (NBP), First Women Bank Ltd. (FWBL), and Bank of Punjab (BoP).

- Approval Time: The approval process may take several weeks, depending on the bank’s assessment of the business plan and the applicant’s credentials.

Government Support and Mentorship

In addition to financial assistance, the Prime Minister Youth Business Loan offers a holistic approach by providing guidance and mentorship. The program offers training and business development support to entrepreneurs who receive the loan, helping them manage and grow their businesses effectively. These initiatives equip entrepreneurs with the skills needed to sustain their ventures and reduce the failure rate of new businesses.

The program also collaborates with several business incubators and accelerators, offering young entrepreneurs access to mentorship from experienced professionals, networking opportunities, and guidance on how to scale their business.

Success Stories and Economic Impact

Since its inception, the Prime Minister Youth Business Loan has played a vital role in changing the lives of thousands of young Pakistanis. Several success stories have emerged, with young entrepreneurs starting businesses in sectors ranging from agriculture and technology to manufacturing and retail. These businesses have not only created employment opportunities for others but have also contributed to the economy through increased production and innovation.

The program has had a positive impact on the country’s economy, particularly in rural and underdeveloped areas, where young people often lack opportunities for employment or entrepreneurship. By encouraging self-reliance and business ownership, the loan program helps to address the issue of youth unemployment, which is a pressing challenge in Pakistan.

Challenges and Criticisms

While the Prime Minister Youth Business Loan program has received praise, it has also faced some criticism. Some challenges include:

- Accessibility Issues: In rural areas, young entrepreneurs often face difficulties accessing information about the program or navigating the online application process.

- Delays in Loan Approval: Due to bureaucratic hurdles or lengthy bank procedures, some applicants have experienced delays in loan approval, which can be frustrating for those eager to start their businesses.

- Financial Risks:

Conclusion:

For young entrepreneurs with big dreams but limited resources, this loan program offers a lifeline, helping them transform their ideas into reality and contribute to the nation’s prosperity. Discover how eco-friendly practices are transforming e-commerce in our article on The Rise of Sustainable Fashion in Online Shopping. For a reliable shopping experience, visit CyberMart.pk, a top platform for online shopping in Pakistan.

Pingback: IMF Approves $7 Billion Loan to Pakistan - Blog By CyberMart.PK